Everyday spending, everyday sats

Most people think about bitcoin in terms of price charts and trading, not coffee runs and grocery trips. Fold takes the opposite approach by letting you earn bitcoin rewards on ordinary spending with debit, soon to be credit, and gift cards. When you run your usual purchases through Fold, those small rewards can accumulate over time and help you build a bitcoin position as part of your day to day life.

The idea behind everyday earning

Fold is a bitcoin powered personal finance platform that focuses on rewards instead of complex trading screens. You use familiar tools like a debit card or gift cards, and in return you earn a portion of each purchase back in bitcoin, often called sats.

Because the rewards are tied to what you already do: buy groceries, pay for gas, subscribe to streaming services, and all of your other daily purchase behavior. There is no requirement to change your lifestyle for the system to work. Many users lean on Fold as a way to accumulate bitcoin gradually and consistently through their existing spending habits, instead of making separate purchases of bitcoin.

Three ways to earn with Fold

Fold brings together multiple earning surfaces so daily spending can stack rewards in more than one way.

1. Debit card for daily swipes

The Fold debit card is built to earn bitcoin rewards on everyday card transactions. Whether you are grabbing a coffee, tapping for your commute, or paying at the grocery store, eligible purchases can return a percentage of the spend back to you in bitcoin.

Users have run billions of dollars in transactions through the Fold debit card, generating tens of millions of dollars worth of bitcoin rewards over time. That scale shows how small purchases, repeated across many users and many days, can add up into meaningful bitcoin balances.

2. Automations for effortless stacking

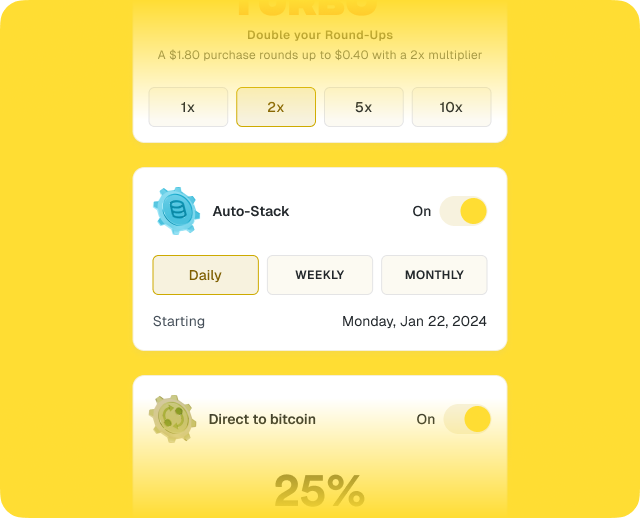

Fold’s bitcoin automations, including Auto-Stack and Round-Ups, are designed to turn everyday activity into scheduled or spare change bitcoin buys without needing to think about timing the market. Auto-Stack lets you schedule recurring bitcoin purchases at a cadence you choose, like daily, weekly, or monthly, while Round-Ups can round each Fold Card transaction to the nearest dollar and use the difference to automatically buy bitcoin.

With multipliers, Round-Ups can even boost how much of your “digital spare change” goes into bitcoin, up to several times the normal round-up amount, so frequent small purchases start to feel like a quiet bitcoin saving plan in the background.

And for users who enjoy putting more of their spending on cards, we know you are anxiously awaiting our bitcoin rewards credit card. This card will give you another way to earn sats on everyday purchases in addition to automations and debit.

3. Gift cards for boosted rewards

Inside the Fold app, you can purchase gift cards for popular brands and earn higher bitcoin rewards rates compared with many standard card transactions. Examples include national chains for groceries, home improvement, food delivery, travel, and more, with some offers reaching into double digit percentage ranges.

One common pattern is to buy a gift card for a store you already plan to visit, then use that gift card to pay at checkout. That way, your usual grocery run or coffee habit can deliver a higher bitcoin reward than paying directly at the register without that extra step.

How small purchases add up over time

Thinking in terms of months makes it easier to see how routine expenses can create steady bitcoin rewards. Here is a simple illustrative pattern for a typical household that routes spending through Fold where supported:

- Weekly coffee or café visits

- A couple of streaming subscriptions and a music service

- Monthly grocery trips and gas fill ups

- Occasional online shopping via gift cards for major retailers

When each of those categories earns a portion back in bitcoin, the sats accumulate in the Fold app and can be tracked in one place. Over time, consistent use of Fold for these repeat purchases can result in a growing bitcoin rewards balance linked to your everyday spending patterns.

Bonus Tip! Coming Soon: Fold's Credit card for flexible spending

Fold is launching a new bitcoin rewards credit card that turns everyday spending into a powerful way to stack bitcoin. The Fold Credit Card is built for people who want their rewards to actually work harder for them, transforming ordinary purchases into something that feels like a win every time. Instead of traditional points or miles that get lost or devalued, the value of your spending comes back to you directly in bitcoin rewards, opening the door to a new way to save, earn, and participate in the bitcoin economy. Because credit cards are often used for larger or recurring expenses, this can extend your earning surface beyond day to day debit spending.

Making Fold part of your routine

The most powerful part of everyday earning is that it becomes a habit. Instead of thinking about bitcoin only when markets move, you can build a simple routine where Fold is the default card for daily swipes, and the app is where you look for gift card opportunities before big purchases.

Some users focus on putting as many eligible recurring expenses as possible through Fold to keep their earning consistent month over month. Others lean more on gift cards to maximize rewards for specific merchants, then use the card for everything else, treating the accumulated bitcoin as a record of their ongoing participation in the network.

Everyday expenses are going to happen either way, but with Fold they can also become a steady stream of bitcoin rewards. By using Fold’s debit card, upcoming credit card, and in app gift cards where available, you can turn coffee runs, streaming subscriptions, and grocery trips into sats you can see and track in one place.

Ready to put your daily spending to work? Open the Fold app to explore debit, credit, and gift card rewards on the purchases you are already making.

* Rewards are subject to the terms and conditions in effect at the time and may change. See Fold’s Terms and Conditions for current details: https://Foldapp.com/legal/terms-and-conditions.

Disclaimer: Fold does not provide financial, investment, or tax advice. This content is provided for informational and educational purposes only and does not constitute a recommendation, solicitation, or guidance regarding any financial decision or strategy.