Introducing ACH Rewards: Earn Rewards on your Mortgage, Rent, and Bills

You may have noticed a shift recently as we began highlighting the account and routing number at Fold and there’s a big reason for this. Fold can now handle 100% of your monthly expenses no matter what method you use to pay them. From direct deposit to bill pay, Fold is the most convenient place to manage your personal finances in bitcoin and dollars. We don’t stop at convenience, Fold gives rewards up to 1.5% on bills paid via ACH like your mortgage and rent starting today!

The Fiat World is Getting Harder

Inflation is up. Interest rates are up. Down payments are out of reach.** Purchasing power is down. Rents are up. It doesn’t take much imagination to look around and see that life on dollars is harder than it was a few years ago.

Consumers deserve currency choice in managing their personal finances. It’s frustrating to have to manage multiple accounts and complex investments in order to keep pace with fiat debasement.

Fold (and Bitcoin) Fixes This

Fold can now be the center of your financial life, that integrates bitcoin to make life better. Fold provides the currency you prefer and the banking* features you need while also giving up to 1.5% bitcoin back on bills like your mortgage, credit card, and rent.

This effectively refinances your mortgage rate lower by simply switching your primary account! And as the bitcoin rewards you earn continues to grow, your rate gets lower and lower and lower. The average reward distributed on Fold has already grown 118%!

How it works

Here’s how to turn the pain of paying bills into the prize of bitcoin rewards.

- Head to the Home tab and grab your account and routing number.

- Connect your account and routing number to all your billers.

- Watch as you earn rewards on your largest bills!

At the end of each month, we’ll send you a round-up telling you how much qualifying spend you made, and what rewards you can expect to earn on your upcoming ACH payments.

Right now, this is a Fold+ exclusive feature, so it’s a good time to upgrade.

How to maximize your Bill Pay Rewards

Bill Pay Rewards was designed to reward those that use their Fold Account as their primary means of spending, buying bitcoin and paying bills. So, the more you use Fold, the more you will benefit from the feature.

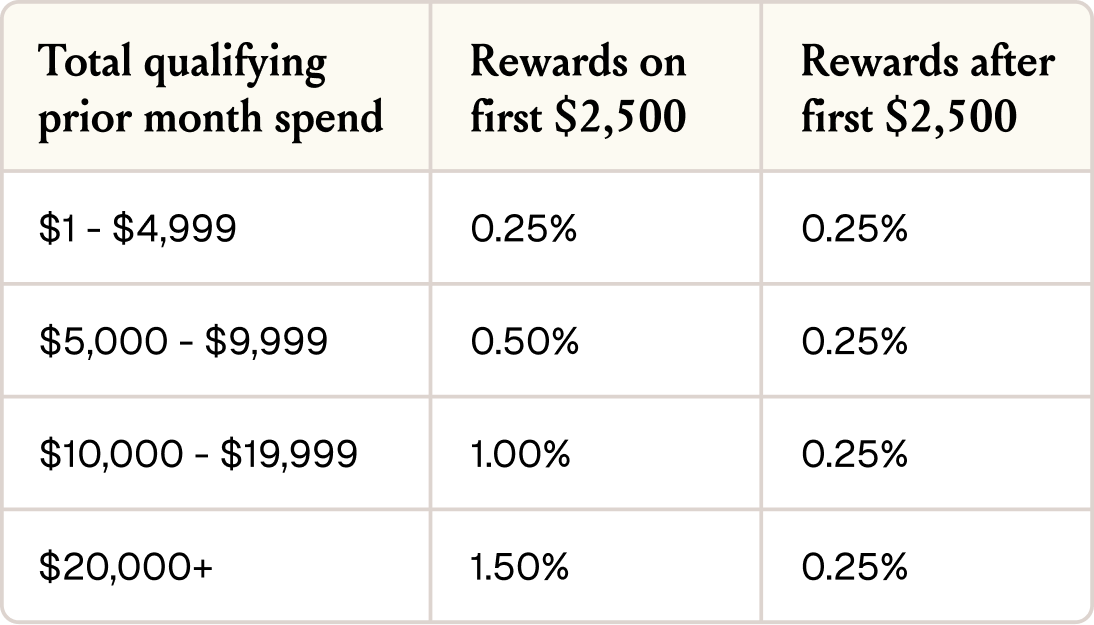

TL;DR: Earn rewards on ACH payments each month up to your total qualifying non-ACH spend from the prior month. Reward percentages are determined by tier and spend amount.

Here’s some examples:

Tim

Tim converts his $10,000 paycheck 100% into bitcoin every month on Fold. This means that Tim will earn 1% back on his first $2,500 in ACH payments and 0.25% on anything else up to his previous month's qualifying spend (i.e. - $10,000) when he pays his mortgage with Cenlar and credit card with Chase.

Mary

Mary uses the debit card for some of her monthly expenses ($2,500) and DCA’s $25/day, for a total of $5,750 monthly spend. That means that Mary will earn 0.50% on her monthly rental payment of $2,000.

Alice

Alice goes all in on Fold, funneling all her monthly spending ($12,000) and bitcoin buying ($9,000) through the app. This means that Alice will earn 1.5% on her first $2,500 in ACH payments and 0.25% on anything above that (up to her qualifying spend) when she pays her AMEX card and mortgage payment on her home in Florida.

For more specifics on what counts as qualifying spend and any additional questions check out our support article on the topic of ACH rewards.

What’s Next?

60% of Fold users in a survey earlier this year anticipate the need for additional financial services incorporating bitcoin. This is our mission to deliver on that. Our mission is to create the number one best account for managing your personal finances across bitcoin and dollars while serving the growing need for additional financial services.

*Fold is a financial services platform and not an FDIC insured bank. FDIC deposit insurance coverage only protects against the failure of an FDIC-insured deposit institution. If you have a Fold Card, up to $250,000 of your balance is covered by FDIC insurance on a pass-through basis through Sutton Bank, Member FDIC, if certain conditions have been met. Bitcoin assets are not FDIC insured.

The Fold Card is issued by Sutton Bank, Member FDIC, pursuant to a license from Visa U.S.A.. Inc. Visa is a registered trademark of Visa, U.S.A., Inc. All other trademarks and service marks belong to their respective owners. Reward Accounts and bitcoin are not FDIC or SIPC insured. Bitcoin involves certain risks and may lose value. Fortress Trust provides Bitcoin services. See Terms of Use here.

**1. https://www.lendingtree.com/home/mortgage/homeownership-dreams-survey/2. https://abcnews.go.com/US/credit-card-users-avoid-mounting-debt-bills-reach/story?id=1064790703. https://x.com/KobeissiLetter