New year, new bitcoin habits

The beginning of a new year is a natural pause point to look at how your money flows through your life. Instead of trying to overhaul everything at once, Fold can support you in building small, repeatable actions that may earn bitcoin on what you already do. To start the new year on the right foot, we have created a simple three step checklist designed to help you set financial intentions with the help of the Fold app for 2026.

Step 1: Refresh your Fold Foundation

A strong routine starts with a clean, secure account that feels ready for daily use. Inside the Fold app, you can review your profile details, confirm your contact information, and turn on notifications so you see when rewards post or when important activity occurs.

Security habits can support your peace of mind while you focus on using Fold day to day. Many users, across all apps, review settings such as passcodes, FaceID and 2 factor options, check which devices are logged in, and get familiar with where to find activity history so they can quickly spot anything that does not look right.

Step 2: Turn on earning with your everyday spend

Once your foundation is set, the next step is deciding how you want Fold to participate in your regular spending. After adding funds and activating your debit or credit card, you can use the card for routine categories like groceries, gas, or streaming services so those purchases can earn bitcoin rewards.*

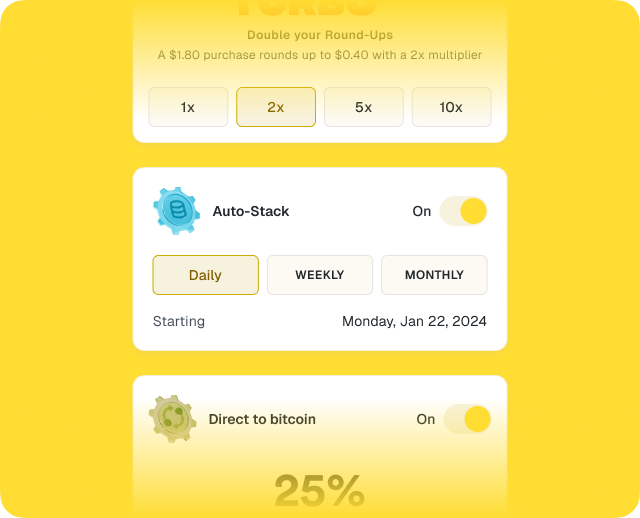

Features like round ups and auto stack are designed to help you build consistency by moving small amounts on a schedule or by rounding card transactions, which can support a “set it and let it run” approach. Within the app, you can explore how these tools work, choose the settings that fit your comfort level, and update them at any time as your habits change.

Step 3: Give your rewards a simple game plan

Having a clear, simple plan for how you use Fold can make it easier to stick with your intentions as the year gets busy. Many users pick a small set of predictable actions, such as using their Fold debit card for a weekly grocery trip, purchasing select merchant gift cards through Fold, or paying specific bills (where available), so they know exactly when they will earn bitcoin rewards.

Fold’s gamified experiences, including the spin wheel, can make checking in feel more engaging, but you are always in control of how often you participate. By pairing a few automatic features with a handful of intentional actions, your bitcoin earning can become another normal part of your month instead of something you have to remember from scratch each time.

Simple frameworks to keep you on track

To keep new habits realistic, it helps to define a lightweight framework you can revisit throughout the year. One example is the “1 3 1” approach with Fold:

- One check in per day to open the app, review recent activity, and don’t forget to spin the wheel.

- Three categories where you primarily use your Fold card, like groceries, gas, and online shopping.

- One automated feature, such as round ups or auto stack, turned on to support consistent earning.

You can also create personal checkpoints, such as reviewing your Fold dashboard at the end of each month to see how much bitcoin you have earned and whether you want to adjust any settings. These quick reviews are designed to help you stay informed and aligned with your own financial intentions without turning it into a full time project.

Use Fold as a tool, not a resolution

New year energy can fade, but tools and systems can keep working for you in the background. Fold is built to make bitcoin rewards part of everyday life through familiar actions like spending on your card, buying or selling bitcoin in app when it fits your plan, purchasing gift cards, or using bill pay where available.

By thinking of Fold as part of your broader financial toolkit rather than a short term resolution, you can build habits that feel sustainable beyond January. The more you align Fold with routines you already have, the easier it can be to maintain your 2026 intentions throughout the year.

Stepping into 2026 with clear financial intentions does not have to mean starting from scratch. With a refreshed account, everyday earning turned on, and a simple game plan for your rewards, Fold can support you in making bitcoin part of your normal money habits.

Open the Fold app to walk through the three step checklist, update your settings, and choose the actions that fit your routine today.

* Rewards are subject to the terms and conditions in effect at the time and may change. See Fold’s Terms and Conditions for current details: https://foldapp.com/legal/terms-and-conditions.

Disclaimer: Fold does not provide financial, investment, or tax advice. This content is provided for informational and educational purposes only and does not constitute a recommendation, solicitation, or guidance regarding any financial decision or strategy.